how to calculate net debt from cash flow

Net cash flow 10 million - 3 million 500000 Net cash flow 75 million. Finally the formula for operating cash flow can be derived by adding net income step 6 and non-cash charges step 7 and then deducting change in working capital step 8 and capex step 9 from the result as shown below.

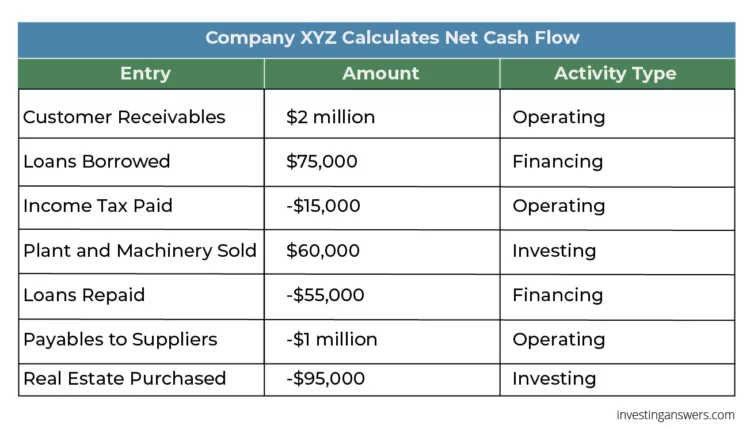

Net Cash Flow Formula Definition Investinganswers

Another way to calculate the cash flow-to-debt ratio is to look at a companys EBITDA rather than the cash flow from operations.

. The cash flow most commonly used to calculate the ratio is the cash flow from operations Operating Cash Flow Operating Cash Flow OCF is the amount of cash generated by the regular operating activities of a business in a. Setting up a Net Working Capital Schedule. No need to calculate our net cash burn.

Instead we can calculate our gross cash runway. If we have enough cash to cover operating expenses we have positive operating cash flow. Definition - What is Cash Debt Coverage Ratio.

4 Formulas to Use. Discounted cash flow DCF Sum of cash. Operating cash flow Net income Non-cash expenses Increases in working capital.

Below are the steps an analyst would take to forecast NWC using a schedule in Excel. The other cash flows will need to be discounted by the number of years associated with each cash flow. It also includes all non-cash expenses.

FCFE or Free Cash Flow to Equity is one of the Discounted Cash Flow valuation Discounted Cash Flow. In this scenario we will calculate our net cash burn rate and our gross cash. 2 Free Cashflow to Equity FCFE Under this DCF calculation method the value of the equity stake of the business is calculated.

Cash flow is the net amount of cash and cash equivalents. Examples of these non-cash expenses may include amortization and depreciation. To get started calculating your DSCR youll need to calculate both net operating income and debt payments.

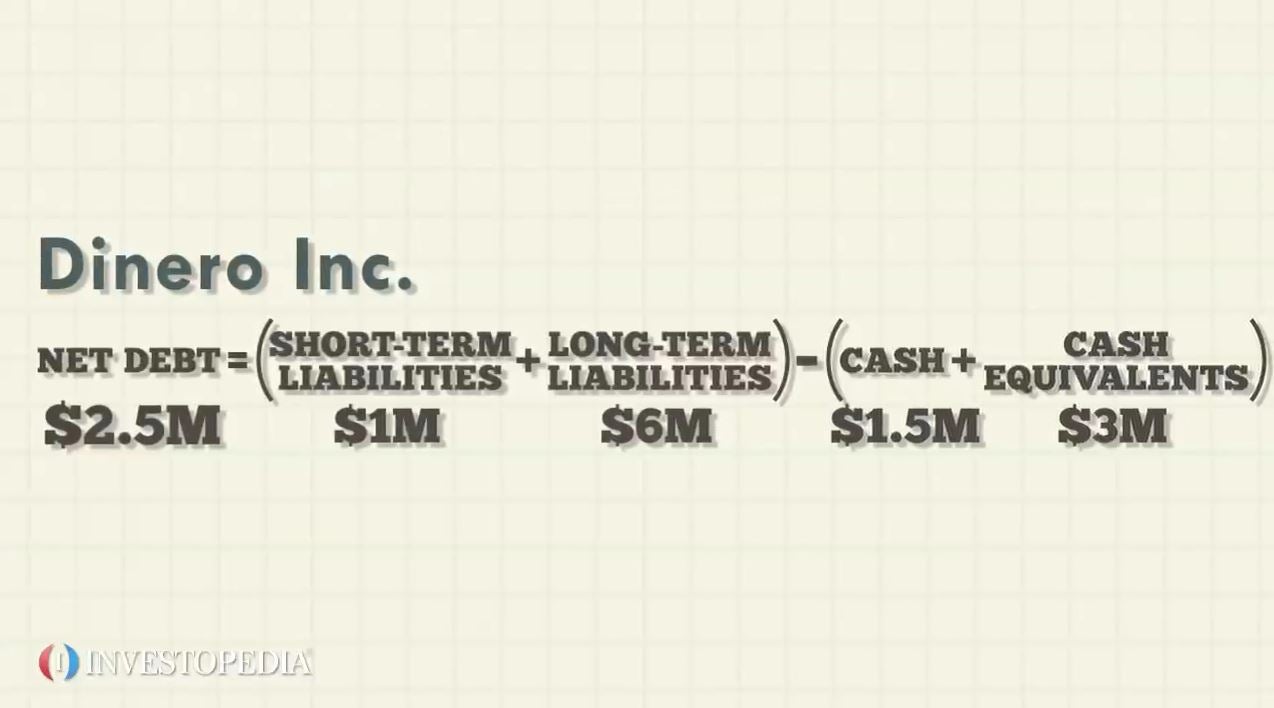

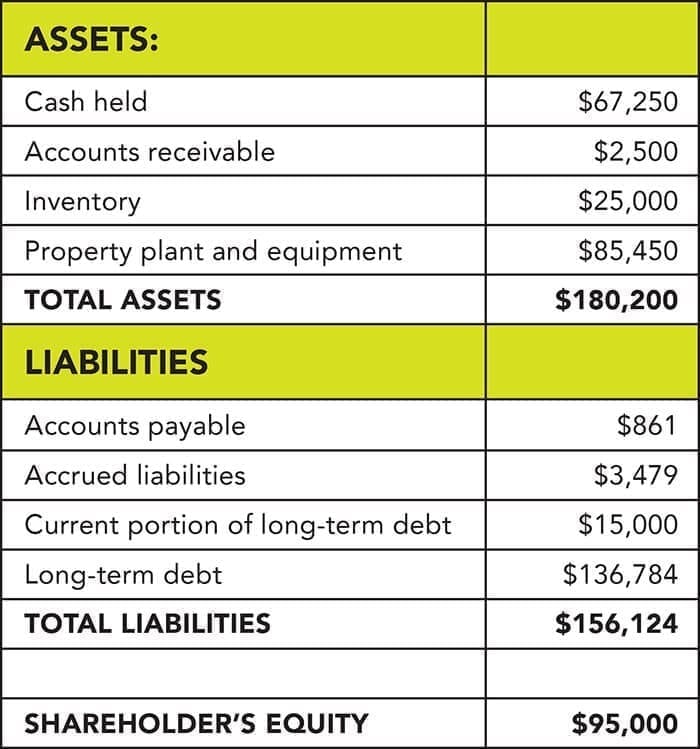

The formula for net cash flow can be derived by using the following steps. We discount our cash flow earned in Year 1 once our cash flow earned in Year 2 twice and our cash flow earned in Year 3 thrice. Total debt Long-term debt Current liabilities short term debt Total Debt.

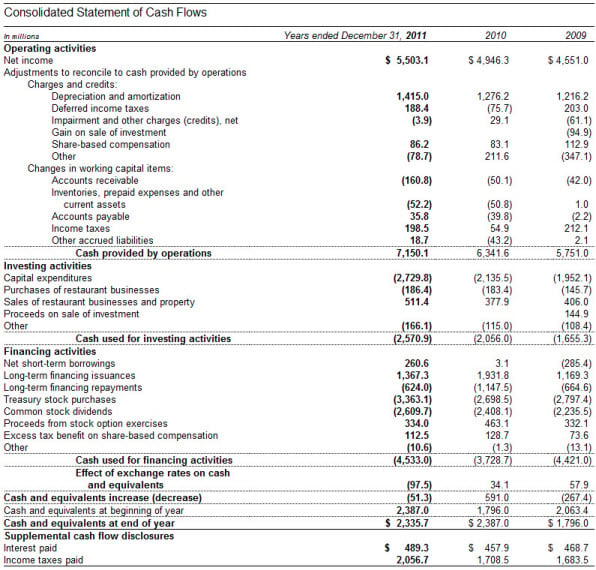

Calculating debt from a. It also reported interest paid of. Cash flow generated by operations includes the net income which is how much they earned after covering business costs.

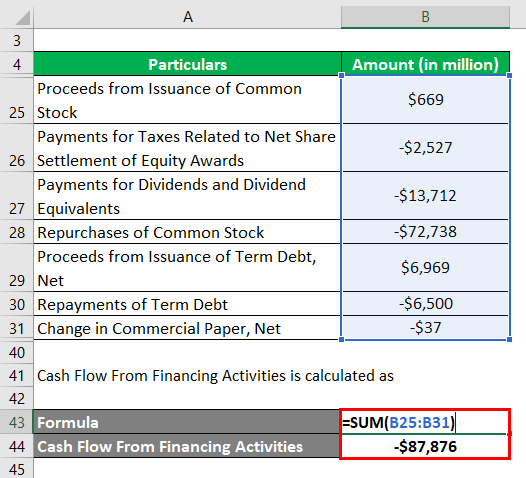

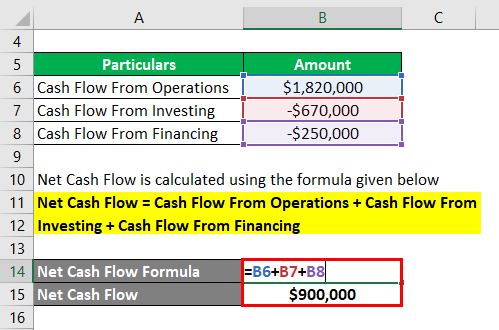

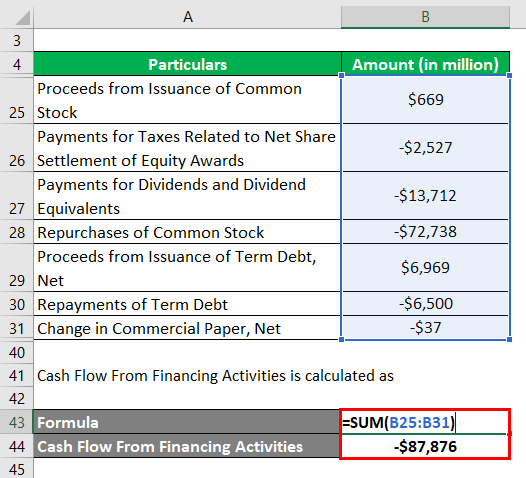

Cash flow Cash from operating activities - Cash from investing activities Cash from financing activities. To calculate net operating income. That is the companys equity shareholders which is the amount the company has after all the investments debts and interests are paid off.

In a balance sheet Total Debt is the sum of money borrowed and is due to be paid. This liquidity ratio is generally regarded as being better when it is. A company has a positive cash flow when it has excess cash after paying for all operating costs and debt payments.

Once we calculate the present value of each cash flow we can simply sum them since each cash flow is time. It is obtained by discounting the expected cash flows to equity ie residual cash flows after meeting all expenses tax obligations and interest and principal payments Principal Payments The principle amount is a significant portion of the total. The more free cash flow a company has the more it can allocate to dividends.

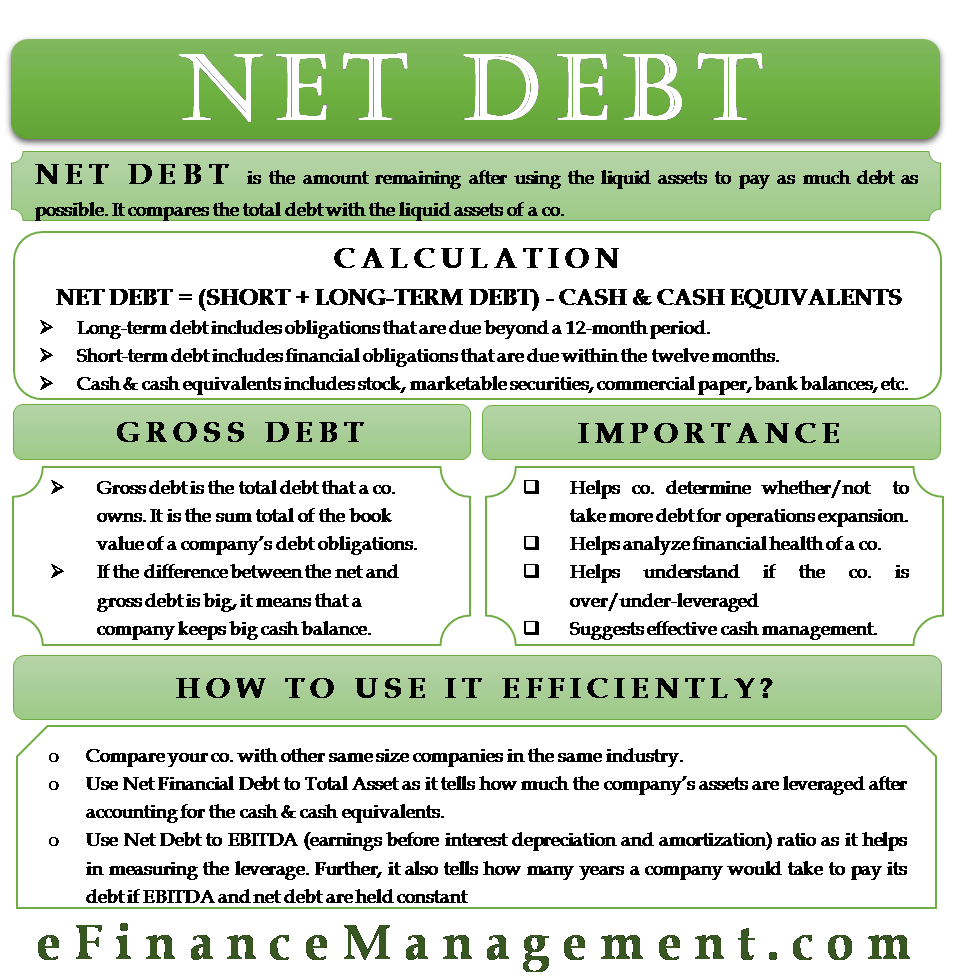

Free cash flow to equity is the total amount of cash available to the investors. How to Calculate Cash Flow. The terms relating to debt that we will understand here are as follows.

The cash flow to debt ratio is a coverage ratio that compares the cash flow that a business generates to its total debt. The Cash Debt Coverage Ratio or the cash flow to debt ratio looks at the relationship between the operating cash flow of a company to its total liabilities and implies what the actual ability of the business to pay back its debt from its operations is. Free cash flow FCF is the money a company has left over after paying its operating expenses and capital expenditures.

Revenue - Operating Expenses Net Operating Income. Cash flow from assets includes three types of cash flow in its calculations. The accountant utilized the following formula to calculate the net cash flow.

At the very top of the working capital schedule reference sales and cost of goods sold from the income statement Income Statement The Income Statement is one of a companys core financial statements that shows their profit and loss. Net cash flow can be broken down into three components. Firstly determine the cash flow generated from operating activitiesIt captures the cash flow originating from the core operations of the company including cash outflow from working capital requirements and adjusts all other non-operating expenses.

Cash flow generated by operations. Cash flow forecast Beginning cash Projected inflows Projected outflows. What is FCFE Free Cash Flow to Equity.

If we do not have enough cash to fund operations we are in a net cash burn situation. The Coca-Cola Company reported Net cash provided by operating activities of 7 150 million in its 2007 cash flow statement. Free Cash Flow Net Income Non-Cash Charges Change in Working Capital Capex.

Net Cash Flow Formula Calculator Examples With Excel Template

What Is Net Debt Clydebank Media

Net Debt Formula And Excel Calculator

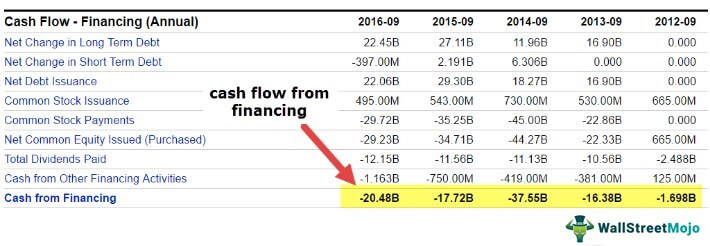

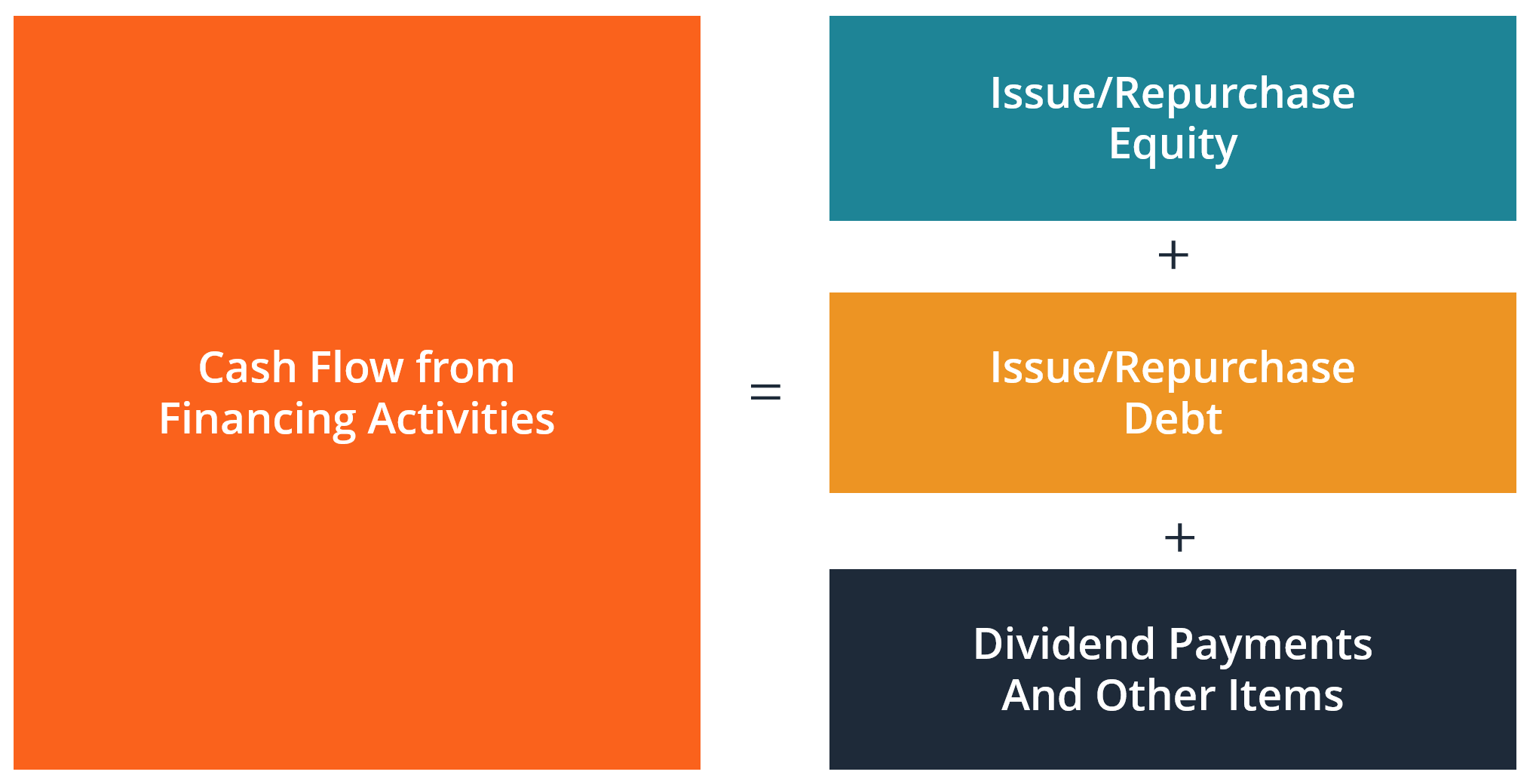

Cash Flow From Financing Activities Formula Calculations

Cash Flow From Financing Activities Overview Examples What S Included

How Do Net Income And Operating Cash Flow Differ

Cash Flow To Debt Ratio Meaning Importance Calculation

Cash Flow Formula How To Calculate Cash Flow With Examples

Cash Flow From Investing Activities Overview Example What S Included

How To Read A Cash Flow Statement Beginners Guide The Babylonians

Net Cash Flow How To Calculate Vs Net Income Importance Analysis

Net Debt Formula And Excel Calculator

Net Cash Flow Formula Calculator Examples With Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template

Net Debt What It Is How To Calculate It And What It Tells

Net Cash Flow Formula Calculator Examples With Excel Template

Net Cash Flow Formula Calculator Examples With Excel Template